TomWan

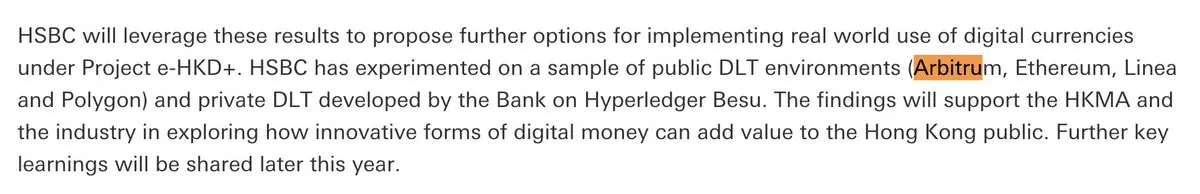

Why I am bullish on tokenization:

SEC: I also hear from our regulatory policy staff that firms—from household names on Wall Street to unicorn tech companies in Silicon Valley—are lined up at our doors with requests to tokenize.

SEC: I also hear from our regulatory policy staff that firms—from household names on Wall Street to unicorn tech companies in Silicon Valley—are lined up at our doors with requests to tokenize.

WHY1.43%